Join the Crypto Investor | get a $1 welcome bonus | Follow the link ->

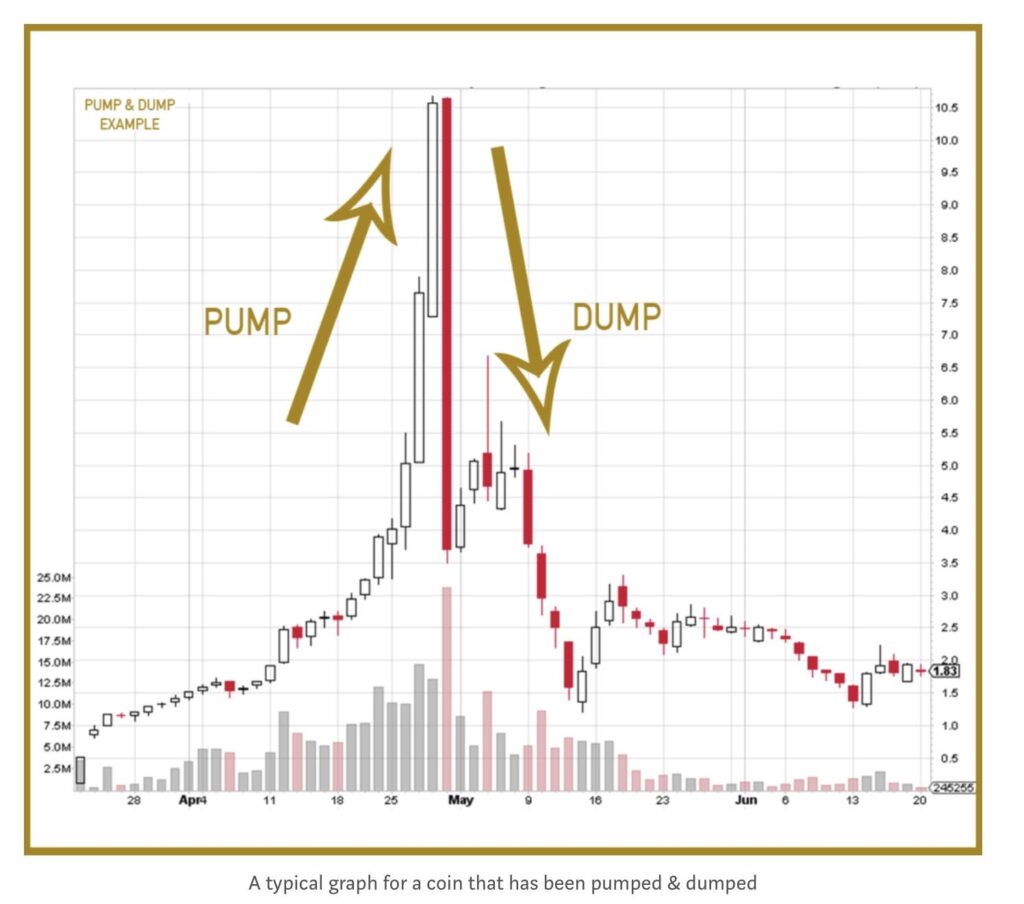

In the world of cryptocurrency trading, exchanges like KuCoin have garnered significant attention due to their dynamic and fast-paced nature. However, an increasingly prevalent concern pertains to the rise of pump-and-dump schemes facilitated by algorithmic trading bots on platforms like KuCoin. In this article, we’ll explore the top 5 reasons why participating in pumps on the KuCoin exchange might not be a profitable venture for the average trader, shedding light on the dominance of algorithmic trading and its potential impact on individual profitability.

KuCoin has become a breeding ground for algorithmic trading bots that execute high-frequency and coordinated trades within microseconds. These bots are designed to exploit market inefficiencies and capitalize on price differentials, often leaving manual traders at a disadvantage. With the rapid pace of algorithmic trading, regular traders find it challenging to compete, as they cannot match the speed and precision of these automated systems.

Pump-and-dump schemes on KuCoin are orchestrated with remarkable precision, requiring traders to execute trades within a narrow time window to maximize profits. Algorithmic trading bots excel in executing trades instantly, minimizing latency and ensuring accurate trade placements. In contrast, manual traders are often delayed by human limitations, potentially missing out on profitable opportunities.

Participating in pump-and-dump schemes carries substantial risks, including the possibility of significant financial losses. Algorithmic trading bots exacerbate these risks by amplifying price volatility during pumps, making it challenging for manual traders to predict price movements accurately. This heightened volatility can lead to unexpected losses for traders who are not well-equipped to handle rapid market fluctuations.

Algorithmic trading bots have access to a vast array of market data and real-time information, allowing them to make data-driven decisions. In contrast, manual traders often lack access to the same level of information and insights, making it difficult to make informed trading choices during pumps. This information asymmetry puts manual traders at a distinct disadvantage, hindering their ability to make profitable trades.

Pump-and-dump schemes on KuCoin can trigger emotional responses such as fear of missing out (FOMO) and impulsive trading decisions. Algorithmic trading bots remain unaffected by such emotions, maintaining a disciplined approach to trading. Manual traders, however, may succumb to these psychological pressures, leading to hasty and irrational decisions that can result in losses.

In conclusion, participating in pump-and-dump schemes on the KuCoin exchange presents a myriad of challenges for regular traders, primarily due to the dominance of algorithmic trading bots. The unparalleled speed, precision, and access to information enjoyed by these bots often leave manual traders struggling to compete. As the cryptocurrency market continues to evolve, understanding the implications of algorithmic trading is crucial for traders seeking to navigate the landscape effectively. It’s essential for traders to exercise caution and adopt prudent trading strategies that align with their risk tolerance and financial goals.

DigitalMarketX has earned a reputation for upholding integrity and transparency in its operations. The platform prioritizes fair practices, ensuring that pump-and-dump schemes are conducted openly and ethically. Traders can be confident that the pumps on DigitalMarketX are conducted with genuine intentions, fostering a sense of trust and credibility that is essential in the volatile crypto space.